1346 results found

- Risk Insurance and Climate Change

RMN DZXL 558 MANILA: ANG TINIG KLIMA WITH IC DEPUTY COMMISSIONER ERICKSON BALMES AND PIRA EXECUTIVE DIRECTOR MICHAEL RELLOSA Press release Please catch PIRA Executive Director Mr. Mitch Rellosa as one of the guest speakers to the DENR 's weekly radio program Ang Tinig Klima. They will talk about “Risk Insurance and Climate Change.” The program will be simultaneously aired over DZXL, 558 RMN radio station. It is also be live-streamed through DZXL and DENR CCS Facebook, this coming October 15 from 3:00 pm to 5:00 pm.

- MANILA TIMES TV with PIRA Executive Director Michael F. Rellosa

Insurance Laban Sa Lindol

- ONE NEWS PH with PIRA Executive Director Michael F. Rellosa

Filipinos urged to avail of theft insurance

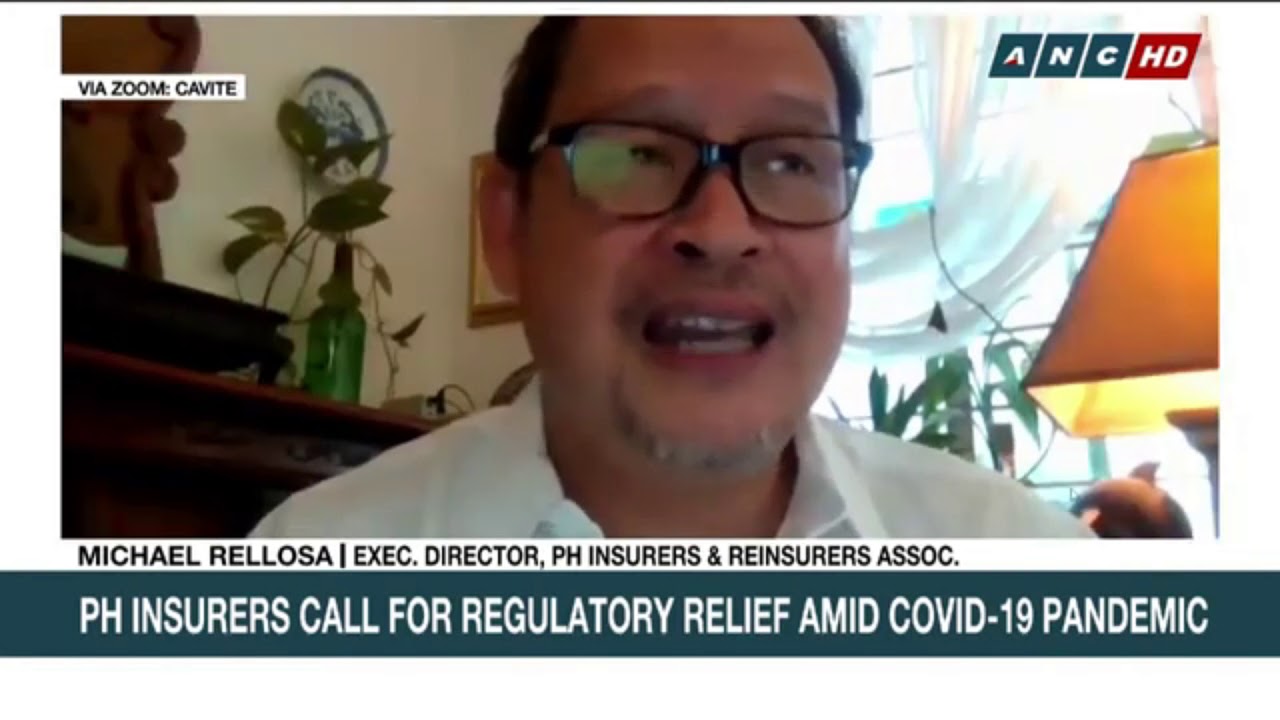

- ANC Interview with PIRA Executive Director Michael F. Rellosa

PIRA speaks on industry issues

- State-run agricultural insurer turns to the private sector in co-insurance scheme

State-run Philippine Crop Insurance Corp. (PCIC) has entered into its first-ever agreement with a private firm to insure farmers and their yields and reduce its risk exposure that could result in its financial collapse. The PCIC signed a co-insurance deal with CARD Pioneer Microinsurance (CPMI) to share the risks underwritten for each insurance policy at a ratio of 70:30, reported The Philippine Star. Under the arrangement, CPMI will serve as the lead insurer, while the PCIC will stand in as the co-insurer, as the private entity will market PCIC's insurance plans to farmers. Under the agreement, PCIC will also provide technical support to CPMI on actuarial matters, claims management, policy administration and risk underwriting. The microinsurance firm will focus on insuring high-value crops in select provinces where the PCIC has failed to expand its coverage to. As such, the agreement is seen to benefit farmers in far-flung areas who require insurance money to rebuild in times of calamity. Insurance Commissioner Dennis Funa said he expects the public-private partnership to contribute to the government’s target to raise insurance coverage among farmers in the countryside. Protection gap in agriculture Mr Funa said, “In past years, the PCIC has solely provided multi-peril crop insurance for various types of agricultural commodities and the government has subsidised insurance premiums to the benefit of small farmers in the country. “Despite this, insurance coverage among farmers in the Philippines is still low. Clearly, there is a need to address the protection gap in the agricultural sector, considering its exposure to severe and frequent disasters.” Finance officials have previously flagged the PCIC for its impending collapse due to its reliance on state subsidies in pursuing its mandate. Source: asiainsurancereview.com

- Regulator issues guidelines for takaful undertakings

The Insurance Commission (IC) has released baseline guidelines for insurers and mutual benefit associations for carrying out takaful or Islamic insurance undertakings. The guidelines took effect immediately on the publication of a circular on takaful which was dated 27 January 2022. Hitherto, there had been no regulatory framework for Islamic insurance in the Philippines. The circular says that the guidelines shall apply to all existing and authorised insurance companies and mutual benefit associations that will set up takaful windows. Insurance Commissioner Dennis Funa said in the circular, "The takaful operator shall have in place an appropriate mechanism for obtaining rulings from Shariah scholars, applying fatwa and monitoring Shariah compliance in all aspects of its products, operations and activities." A complete governance policy framework, which outlines the strategic duties and tasks of each organ of governance, as well as procedures for balancing stakeholder accountability, must also be established by an operator. The IC notes that lslamic finance is a rapidly growing segment of internalional finance, which when expanded in the Philippine setting, may attract funds from lslamic investors looking for opportunities to support social and infrastructure requirements in the country. The regulator adds that it recognises the need to provide broader insurance coverage and options for all Filipinos, especially the Muslim community. Takaful is a budding area that the insurance sector can explore in light of the implementation of the Updated Philippine Development Plan (PDP) 2017-2022 that identifies the need for a resilient and inclusive financial sector and lays down, as one of the strategies, the development of legal infrastructure for lslamic banking and finance, the IC says. Source: meinsurancereview.com

- Non-life insurers want minimum capital requirement kept at current level

Non-life insurers want the industry regulator to stipulate that the minimum capital requirement would be maintained at the current level of PHP900m ($17.6m) under a pending Senate bill aimed at raising the minimum to PHP1.3bn by the end-2022. In a letter, last month to Senator Grace Poe, who chairs the Senate committee on banks, financial institutions, and currencies, the industry group Philippine Insurers and Reinsurers Association (PIRA) noted that the current minimum net worth required among insurance players was “sufficient” to maintain insurers' solvency, according to a report on the news website Inquirer.net. Also, the PHP900m minimum capital requirement in place since 2019 is already among the highest in the region, PIRA chair Edgardo Rosario said. PIRA told Ms Poe that non-life companies in Vietnam had a net worth requirement equivalent to at least PHP667.9m; PHP517.7m in Indonesia; PHP480m in Thailand; and PHP363.4m in Singapore. The group said the prevailing net worth level was “more than sufficient as [it acts] as buffer or early warning signal before a company shall be unable to pay its claims and liabilities to policyholders and creditors.” The Philippine Life Insurance Association is also working on its comments on the proposed law amendment, its general manager George Mina said. Source: asiainsurancereview.com

- Courtesy of BM: ‘More Pinoys bought insurance via GCash’

FINANCIAL technology (fintech) player GCash said it has helped provide 100,000 Filipinos with insurance products, which now amount to a total coverage of about P8.3 billion. In a statement, GCash President Martha Sazon described this feat as an “explosive growth” which, she said, reflects that Filipinos are now growing more accepting and trusting of insurance. “With the pandemic unfortunately continuing on in 2021, together with a myriad of other health and life-threatening conditions, insurance is a must. GInsure democratizes insurance to Filipinos through a variety of very affordable insurance products, including protection from dengue and Covid-19, protection from income loss, and hospital coverage benefits,” she said. GInsure is an in-app feature that allows GCash users to purchase insurance products offered by Single and MicroEnsure. “With our partnership with GCash, more people are getting over the notion that insurance is intimidating or expensive or complex. Our alliance is proof that insurance can be affordable, simple and easy to access,” AXA Philippines President Rahul Hora said. AXA underwrites the insurance policies offered by MicroEnsure. “Partnering with GCash enabled Singlife to reach millions of Filipinos almost instantly, giving them access to meaningful protection products without breaking the bank in a modern, fuss-free manner,” said Singlife Philippines CEO Rien Hermans. In the Philippines, only close to 40 million Filipinos have insurance policies, and 22.8 million of which were made through microinsurace. The Insurance Commission targets to bring this number to about 50 million by 2022. By Lorenz S. Marasigan Business Mirror Link to original post: https://businessmirror.com.ph/2021/02/25/more-pinoys-bought-insurance-via-gcash

- Financing climate adaptation in the Philippines: the value of nature

The Philippines is one of the world’s most vulnerable countries to climate change, with USD 5 billion of GDP at risk from increased typhoons over the next 10 years. Nature in the Philippines represents a valuable cost-effective tool for climate adaptation: Mangroves have been found to be as much as fifty times cheaper than building and maintaining a coastal cement seawall, and restoring them could yield $450 million per year in flood-protection benefits. However, these values are not yet factored into the country’s main financing and investment institutions: the Philippines has already lost 50% of its mangroves to deforestation. Starting in 2017, Earth Security, with funding from the international climate fund (IKI) of Germany’s Federal Ministry of the Environment, Nature Conservation and Nuclear Safety developed a research and strategic partnership programme to mobilise finance decision-makers in the Philippines to recognise the value nature-based adaptation. In 2020, in partnership with the Philippines’ government and the Asian Institute of Management, Earth Security has launched: Source: earthsecurity.org